When started

Launched on 18 February, 2016 by Prime Minister Narendra Modi.

Highlights of the scheme

- Scheme is in line with One Nation – One Scheme Theme.

- Replace the existing two schemes - National Agricultural Insurance Scheme as well as the Modified National Agricultural Insurance Scheme.

- There will be a uniform premium of only 2% to be paid by farmers for all Kharif crops and 1.5% for all Rabi crops.

- In case of annual commercial and horticultural crops, the premium to be paid by farmers will be only 5%.

- There is no upper limit on Government subsidy. Even if balance premium is 90%, it will be borne by the Government.

Objectives

- To provide insurance coverage and financial support to the farmers in the event of failure of any of the notified crop as a result of natural calamities, pests & diseases.

- To stabilize the income of farmers to ensure their continuance in farming.

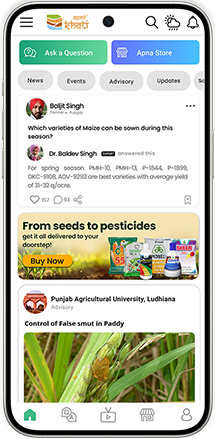

- To encourage farmers to adopt innovative and modern agricultural practices.

- To ensure flow of credit to the agriculture sector.

Farmers to be covered

- All farmers growing notified crops in a notified area during the season who have insurable interest in the crop are eligible.

- Compulsory coverage: The enrolment under the scheme, subject to possession of insurable interest on the cultivation of the notified crop in the notified area, shall be compulsory for following categories of farmers.

- Farmers in the notified area who possess a Crop Loan account/KCC account (called as Loanee Farmers) to whom credit limit is sanctioned/renewed for the notified crop during the crop season.

Risks covered under the scheme

- Yield Losses (standing crops, on notified area basis).

- Comprehensive risk insurance is provided to cover yield losses due to non-preventable risks, such as Natural Fire and Lightning, Storm, Hailstorm, Cyclone, Typhoon, Tempest, Hurricane, Tornado. Risks due to Flood, Inundation and Landslide, Drought, Dry spells, Pests/ Diseases also will be covered.

- In cases where majority of the insured farmers of a notified area, having intent to sow/plant and incurred expenditure for the purpose, are prevented from sowing/planting the insured crop due to adverse weather conditions, shall be eligible for indemnity claims upto a maximum of 25 per cent of the sum-insured.

- In post-harvest losses, coverage will be available up to a maximum period of 14 days from harvesting for those crops which are kept in “cut & spread” condition to dry in the field.

- For certain localized problems, Loss / damage resulting from occurrence of identified localized risks like hailstorm, landslide, and Inundation affecting isolated farms in the notified area would also be covered.